Insight in finance - the light bulb moment!

post

by Alex Roan on 23 Jul 2015

Let’s Start By Defining The Basics

Financial accounts & reports

A balance sheet, profit and loss, cash flow and other KPIs which correctly record and value business activities to accepted accounting standards.

Management accounts & reporting

Additional breakdown of the financial accounts by other dimensions; e.g. product, sales person etc. and other calculated KPIs.

Do these accounts and reports provide insight about a business on their own? - Yes and no.

One of the primary purposes of the financial statements is to give analysts and shareholders information to compare companies on a like for like basis.

An expert can read financial statements and gain ‘insight’ on the business e.g. sales, costs, investments, debt, cash etc. However I would lean towards considering that as limited to a basic understanding on the current state of the business.

So, What Do We Really Consider As Insight?

One definition from the Oxford dictionary is, “An accurate and deep understanding.”

This is a start, but I suspect something more is meant in finance circles. Something like, “Providing information over and above the financial and management reports that will assist in making decisions to improve business performance”. This should be tangible and measurable. For example finance give advice which leads directly to increased revenue, margin, asset utilisation etc.

Let’s say that insight is:

- Applying an accurate, and deep understanding of the business in order to

- Provide information that directly leads to decisions and actions that improve business performance.

A More Detailed Definition

To bring this to life we need to move away from abstract definitions and discuss the details, however first we should raise a potential pitfall, under pressure to provide insight finance should be careful not to confuse their role with other experts e.g:

- Economists - should bring insight related to economic trends, KPIs etc.

- Other functions - should bring their expertise to the areas they manage e.g. marketing & sales should best understand price points.

What Kind of Analysis do Finance Do

Insight is driven from analysis, so it makes sense to think about the typical types of analysis finance does; common examples include:

- Review the finance postings behind business activities; apply business knowledge, identity, investigate and resolve errors

- Review the postings vs. prior period and plan - to identify and explain unexpected activities

- Calculate KPIs - review vs. prior period and plan.

- Develop scenario plans, what if analysis etc.

This analysis brings finance to a clear mechanical description of current business performance, yet it doesn’t on its own cross the boundary into Insight.

A light bulb moment

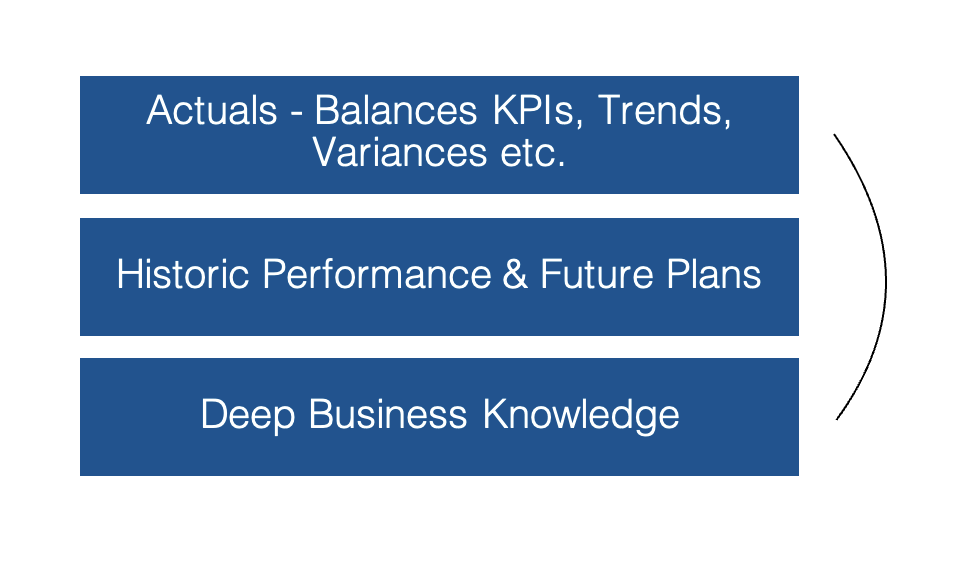

Perhaps the best way to think of insight is that it doesn’t come from one report or KPI, but rather it comes from a skilled individual / team using layers of information:

- An individual or team: with the foundation of a deep understanding of the business

- Add layers of financial information - validated account balances exist, with overlays of finance generated info - prior period, plan, KPI, trend analysis etc.

- Add layers of external information - market analysts, economists - economic reports, product reseach etc.

A light bulb moment - a leap or a light bulb moment, the individual or team bring together the business context and the layers of information to say, “Ah! We should do this”.

Finance can then craft a story backed up by financial information to better plan possible actions.

Examples 1: Inconsistent revenue

A company organises festivals. They have predictable costs, but their revenue varies widely based on factors such as the public expendable income / economy.

- Deep knowledge - Finance have deep understanding of the business - they know historical performance and what has affected it.

- Information - Alternative plan versions, monitoring actual performance against it, overlay of economics, weather, news, sales performance etc.

- Insight - A late spring may affect produce availability and hence cost.

Example 2: Receivables Recovery

A company delivers projects. The demand from clients is highly variable and in addition clients may pay less than agree based on performance: Insight - Finance closely monitor work in progress and debtor receivables, they overlay their knowledge of different clients, sales people etc. to better identify areas of risk, which the business can then plan mitigations.

- Deep knowledge - Finance understand the services, and the business teams, they have a solid view of factors which affect receivables historically difficult clients, poorly performing divisions etc.

- Information - Close monitoring of services provided, outstanding receivables, overlays of performance vs. plan and risk assessments on clients.

- Insight - The ability to identify high risk receivables and focus attention.

These are basic examples, perhaps not quite Aha – light bulb! Moments, have you come across any great examples of finance insight?

Share, comment/discuss

Share to: LinkedIn, X