How to assess operations - part 3

project

by Alex Roan on 1 Jul 2024

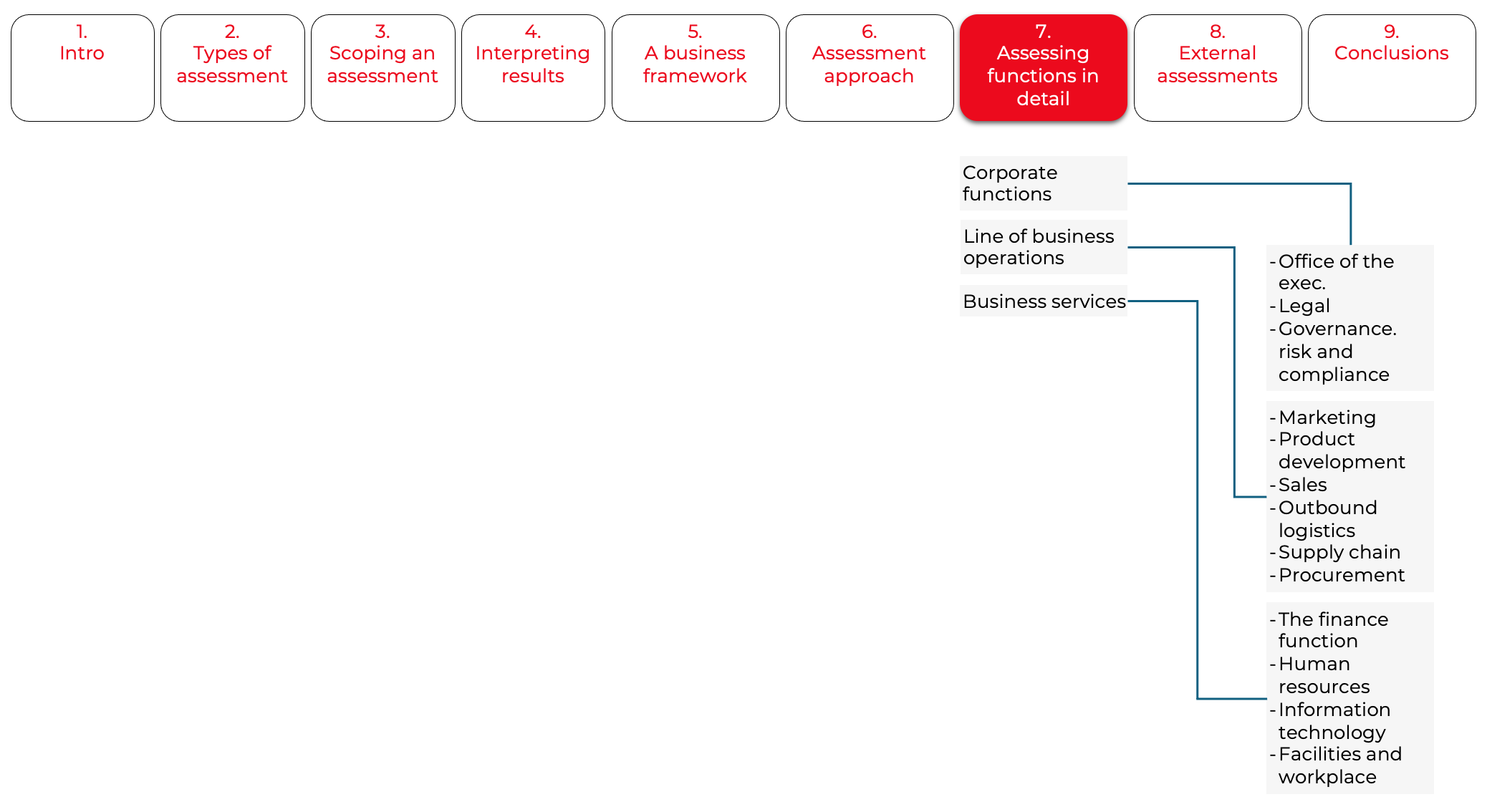

Assessing business areas in detail

Corporate function

Starting from the top the corporate function is an area that houses the executive committee members. It may also house areas such as strategy, legal and external communications.

Office of the executive

Executive committees provide the top level of management that is responsible to ensure organisations meet stakeholder needs. We can consider stakeholders in two groupings:

Primary stakeholders:

- In listed companies these are shareholders. They are interested in value in the form of growth and dividends

- In private companies these are owners. They may be interested in various things, but often growth and profits as well

- In public organisations they vary depending on the organisation. For example:

- In the case of the BBC we could say it's the license fee payers

- In the case of a hospital we could say it's the patients

- In the case of a charity we could say it's their recipients.

Other stakeholders:

There's a fairly broad list of other stakeholders. These include statutory authorities, regulatory bodies, employees, unions, customers, suppliers, the local community and environmental groups. Which of these are relevant and how much focus is put on them will vary by organisation. The nature of responsibility of the executive committee will also vary depending on the stakeholder, for example:

- Statutory authorities: the executive committee must oversee the disclosure of accurate financial statements

- Employees: the executive committee is responsible for various aspects of the working environment and the management of benefits e.g. pensions.

In my experience executives manage these objectives through two different operational views:

- Management of the current operation (daily / short term view)

- Making decisions and plans for the future of the organisation (mid / long term view).

These two focuses break down into individual process areas.

Management of the operation

- Management of major issues and risks

- Monthly and quarterly reviews and corrective actions

- Drafting, reviewing and approving external communications

- Active management of important or high risk external stakeholders.

Making decisions and plans for the future:

- Annual business reviews and corrective actions

- Future planning (annual, long term)

- Review of research on product/market/economic trends

- Oversight of investigations into future opportunities:

- New products, new markets

- Acquisitions

- Leveraging new technology.

In addition to these there is a significant amount of effort in managing collaboration across an executive team. This means committee meetings need strong processes in terms of agenda preparation, chairing, minute taking and follow up action tracking.

Within corporate it's common for organisations to engage strategy consultants, economic/market/product advisors and research agencies. It's less common to engage operations experts. This may be due to the infrequency or variability of corporate processes. This may increase the chance of finding improvements via operational assessment.

I'd consider key assessment topics according to a few categories

Executive committee structure and work systems

- Participation, clarity of roles and responsibilities

- Too many people involved, slowing down decision making?

- Involvement of right or best experts to improve discussion quality?

- Meeting frequency and format

- Is web conferencing and other communication tools optimised?

- Consistency and comprehensiveness of agenda for periodic discussions

- Method for capturing issues discussed, actions agreed and follow through.

Daily work systems can be underrated. A good case study of this is the UK government 'Whatsapp' scandal. Ministers 'Whatsapp' chat histories were leaked. The data showed a few things:

- Decisions were often made at the last minute without a rational analysis

- Opinions were not formulated into options with issues and risks to be considered

- A lot of energy was wasted in complaints and frustration with this approach to management and decision making.

Future planning (annual, long term)

- Are inputs gathered in a structured way (reports, intelligence etc.)?

- Are inputs complete and of sufficient quality?

- Do discussions and decisions involve the right experts?

- Are all options explored before making a decision?

- How well do corporate targets translate to individual plans?

In the book Superforecasting: The Art and Science of Prediction by Philip Tetlock (Author) and Dan Gardner (Author) the authors bring to light the many of the challenges with forecasting. However, one of the common factors they find with 'good forecasters' is a data-based approach, and an ability to see past 'bias' and red-herring 'big ideas'.

Monthly/quarterly business review on actuals vs. plan vs. historic

- How well are results summarised to the executive?

- How clear is executive feedback and is it acted on?

- Are executive comments and concerns formally tracked and resolved.

External communications (annual reports, press statements, investor updates)

- How many drafts and review cycles are undertaken?

- Are errors made?

Investigation into opportunities and challenges

- How long does it take to put together a team, run an analysis?

- What's the success rate of of previous initiatives?

Legal

Outside of the legal industry the legal area in an organisation may be small. Organisations may have in-house lawyers, or managers that engage and co-ordinate external lawyers as needed. Legal is often not a major focus of an operational reviews.

Key processes:

- Corporate legal structure

- Contracting support

- Policy support across all areas

- External communications and disclosures supports

- Legal perspective on business issues and risks

- Managing legal actions.

Questions to consider during an assessment:

- What's the organisations historical legal performance?

- Is legal under or over represented in the organisation?

- Are business areas well informed from a legal perspective?

- This can be gauged by looking at the clarity of policies. For example HR policy on employee severance, data policy on data retention, procurement policy on contract terms.

- Have any legal costs been incurred that may have been avoided. This includes costs such as non-compliance fines, contract break fees, court cases.

Costs to analyse:

- External spend on legal services; which can be very expensive

- Lawyers, consultants and specialist advisors

- Internal costs; likely to be mostly employee related

- Number of employees; salary and benefits

- Travel

- Any other legal fees.

Governance, risk & compliance

This is an area where responsibilities are built into employee and manager roles throughout the organisation.

- Governance: each business area should maintain their own policies, rules and frameworks

- Risks: each business area should run risk assessments and build risk mitigation plans

- Compliance: each business area should ensure they follow all legal, statutory and regulatory requirements.

For example:

- Finance are responsible to ensure annual accounts are submitted externally on time and with quality

- IT or data are responsible to ensure data is used in accordance with data laws.

In order to oversee how well business areas manage this an organisation may have a dedicated governance, risk and compliance team with several responsibilities:

- Overseeing governance, risk and compliance plans and activities

- Carrying out an internal audit

- Providing specialist advice on governance, risk and compliance, including:

- Advising on policy

- Advising on controls

Within certain industries there may be large teams of GRC experts that form a larger business area. For example in banking and insurance there are often separate risk and compliance teams. These industries have a large number of complex disclosures to prepare and a large number of high impact risks which creates significant operational work.

Questions to consider:

As with legal a good place to start is a brief investigation into historical performance in this area:

- Major control failures

- Compliance exceptions

The effectiveness of a GRC organisation can be assessed by how well their objectives are executed throughout the organisation by looking at:

- Volume and quality of policies in place

- Whether roles and responsibilities are clearly defined

- Whether process controls are in place

- Whether data controls are in place

- Whether IT access controls are in place

- A review of exceptions and failures.

Another point to consider is the frequency of and results of GRC assessments:

- Existing operations:

- Operational control / compliance assessments

- Risk assessments

- Assessments for operational changes.

One form of assessment I enjoy reading about is penetration testing. This can apply to physical locations as well as IT systems. Experts use social engineering and IT tools to test an organisations process and access controls. It's surprising how far experts can penetrate into an organisations process, data and systems, highlighting how important GRC assessments are.

Costs to analyse:

- Internal employee costs

- External contractor/advisor/consultant spend

- Cost incurred due to above control or compliance failures.

Line of business operations

Marketing

There can be a lack of clarity around the role of marketing in an organisation. At Procter & Gamble. AG Lafley famously talked about the core of the business as consumer market knowledge (CMK). In this sense marketing is identifying the wants and needs of potential consumers. The management of advertising campaigns also often sit within marketing. In some cases marketing includes leads generation and sales conversion, but I include these in sales. In other cases marketing includes branding, but I include this in product management.

Key processes:

- Create and manage marketing strategies

- Identify the wants and needs in the marketplace

- Define the target market

- Input into product development and branding activities

- Input into sales planning and target setting activities

- Marketing campaigns

- Advertising campaigns.

Key metrics and reports:

- Consumer engagement

- Cost to engage new customers

- Brand awareness

- Return on investment for marketing and advertising campaigns

- (Pipeline, lead and sales metrics as part of Sales)

- With online purchases there may be technology related metrics related to things lick click-through rates etc.

While there are many marketing metrics, an important metric is the connection between marketing campaigns, advertising campaigns and sales. In many cases this may not be well tracked due to the challenges to connect sales to specific campaigns.

Digital businesses may have quite unique approaches where marketing and sales are highly interconnected. For example when marketing and advertising campaigns are online and drive clicks from social media to online stores. In this case many metrics can be tracked across the end to end process.

Questions to consider:

- Past success of marketing and advertising campaigns

- Return on investment of marketing and advertising campaigns

- Use of external agencies and their performance

- Level of market research, source of information.

Key costs to analyse:

- External spend on market research / insights

- External spend on marketing and advertising campaigns

- Promotional materials.

Product development

Key processes:

- Develop products and services to meet marketing wants and needs

- Product

- Brand

- Packaging

- Localisation of global branding and packaging.

Key metrics and reports:

- Sales

- Consumer feedback

Questions to consider:

- Analysis of product launch and sales and consumer feedback.

Key costs to analyse:

- Brand agency costs

- Design agency costs (packaging)

Sales

Key processes:

- Sales planning: from top down sales targets to market/customer plans

- Lead generation

- Pipeline management

- Sales conversion

- Contract management

- Relationship management

- Customer contact centre

- Indirect sales (wholesalers, resellers)

Metrics and reports:

- Product sales, gross margin

- Gross sales:

- Value at cycle stage; lead, total contract, order, invoice

- Value by management dimensions; location, product/service, sales org, sales person

- Customer contact centre metrics (calls, requests etc.)

- Customer feedback.

Key questions to consider:

- Basics of the sales model; direct vs. indirect, customer types etc.

- How well managed are the key processes?

- Level of documentation and standardisation

- Frequency and quality of performance reviews and corrective actions.

- Review of sales performance; product/service by geography, customer etc.

- How does sales performance vary by location, team, individual?

- Identify exceptions and look for reasons for good or bad performance.

- Ratio of employees focussed on sales vs. management or assistance

- Analysis of customer relationship management including:

- Different approaches based on account type / size etc.

- Review of customer feedback

- Review of customer requests (volumes, topics).

- Reasons why leads or existing customers are lost.

Key costs to analyse:

- Employee pay structure:

- Do pay levels mirror performance

- Effectiveness of any bonus or other performance benefit structures.

- IT systems and data management

- Market intelligence.

Outbound logistics

Key processes:

- Warehousing management

- Inventory management

- Stock management and stock counts

- Order picking and packing

- Transportation

- Shipping

- Last mile delivery

- Indirect distribution (wholesalers, retailers)

Metrics and reports:

- Inventory turn-over, stock to sales ratio, sell-through rate

- Safety stock

- Accuracy of forecast rate, demand patterns

- Lost sales ratio

- Perfect order rate

- Inventory shrinkage, average inventory

Key questions to consider:

- Optimisation of stock levels held in inventory

- Demand variability and effectiveness of outbound logistics to manage it

- Analysis of issues

- Customer returns and rejections (wrong product, quantity, condition)

- Customer complaints (late deliveries, product quality).

- Effectiveness of IT systems

- Real time stock updates

- Delivery information portals for customers.

- Operations model for distribution centres (staging, sorting, loading etc.).

Key costs to analyse:

In the case of outbound logistics high costs are likely to be centred around warehouse locations and transportation.

- Warehouses and other storage locations including rent, rates and any physical asset purchase/maintenance costs

- 3rd party logistics agreements for 3rd party warehouses/distribution centres

- Transport contracts

- Employee costs

- Finished product stock write-offs due to damage etc.

Supply chain

Procurement

Within manufacturing procurement is a major part of inbound logistics which focusses on raw materials and packing materials. However, procurement has a broader scope including items such as fixed assets, office supplies and external business services. Therefore I've separated it out from inbound logistics.

Key processes:

High level process areas include:

- Procurement management and policy

- Sourcing

- Contracting

- Ordering

- Vendor management.

Within procurement management and policy important areas include:

- Procurement organisation set up (level of centralisation, scope of categories managed)

- Sourcing approach:

- Usage of tenders, RFIs, RFPs etc.

- Negotiation skills and approach

- Contracting approach

- Policy rules:

- Approved supplier list

- Spend limits and approval limits per category

- Payment methods and terms

- Utilisation of technologies such as e-invoicing, procurement portals, supplier portals etc.

Within the raw and pack space important areas include:

- Sourcing approach for raw and pack (tenders, RFIs, RFPs etc.)

- Special processes such as consignment stock / vendor managed inventory

- 3-way matching (order, receipt, invoice)

- Communication related to returns and handling of credit notes etc.

From a broader procurement perspective important areas include:

- Sourcing specifics for business services. Common examples include:

- IT hosting, software as a service, IT outsourcing etc.

- Business process outsourcing

- Facilities maintenance

- Controls related to purchases without contract or order.

Metrics and reports:

- Spend by various dimensions:

- Spend category: materials, assets, utilities, services etc.

- Spend type: on / off contract, On / off purchase order

- Initiator: Business area, department, team, individual, location

- Payment methods

- Payment terms.

Questions to consider:

- Analysis of the spend as noted above. How do business areas compare? How does the organisation compare to competitors?

- Is there a structured approach to procurement across all spend categories?

- Within manufacturing the high value of raw and pack combined with the focus on cost management usually means there is a highly structured approach to procurement; tenders, negations, contracts, orders-receipts-invoices matching etc. However this may be missing when it comes to other spend categories.

- Is there a single procurement organisation able to leverage scale of organisation wide spend in a controlled way with centrally selected suppliers

- Are payment terms standardised and optimised. This includes a focus on time to pay vs. discounts achieved which will vary depending on cash flow vs. profitability objectives of the organisation.

- Are any purchases made outside of contracts? Were they needed, were they good value

- Are any purchases made without purchase orders? Were they needed, were they good value

- Are preferred payment methods identified in policy and how compliant are suppliers with this

- Feedback from suppliers and open issues and risks lists.

Key costs to analyse:

- Contract purchase rates vs. benchmark

- Any off contract purchases or off order purchases

- Lost discounts.

Inbound logistics

Key processes:

- Procurement for raw and pack

- Transportation

- Receiving

- Inventory management

- Goods movements (into storage, to manufacturing etc.)

Metrics and reports:

- Transportation: less than truckload shipments

- Time to receive

- Supplier quality index.

Key questions to consider:

- Supplier relationship management (covered above, but key for raw and pack):

- Payment on time, discounts achieved?

- Leveraging scale for discounts?

- Negotiation approach and capability?

- Supplier performance; delivery, quality etc.?

- Optimisation of transport costs:

- Level of consolidation of suppliers and discounted rates

- Variability in demand plan and level of optimisation of raw and pack stock levels

- Volume of goods movements, are locations optimised, are unnecessary movements happening

- Transportation scheduling

- Are there wastes in the system (consider the Lean 7 wastes).

Key costs to analyse:

- Raw and pack spend including loss discounts

- Transportation contracts

- Any wastage / write-offs.

Manufacturing

Key processes:

- Production planning

- Production process:

- Raw and packing material transfer to production

- Production line steps

- Finished products receiving into stock

- Plant maintenance

Questions to consider:

- Production costs in detail:

- Including direct and indirect costs

- Looking at performance vs. plan vs. previous periods.

- Analyse product line metrics; downtime, changeovers, reliability, issues, defects etc.

- Look at use of in-house production vs. third party contract manufacturing

- Location considerations; distance from raw materials, cost of utilities, access to workforce, distance from warehousing locations or customers

Key costs to analyse:

- Indirect

- Rent and rates (utilities)

- Workforce

- Asset cost/value (plant machinery)

- Plant maintenance.

- Transport costs

- Contract manufacturing

- Contract warehousing

Business services

The finance function

As finance is an area I focus on I will discuss in a little more detail. It's useful to start by considering the purpose of the finance function. The main objectives are:

- Keep a financial record of business activities:

- Ensure transactions managed by other areas are correctly recorded and valued, for example:

- Goods receipt of raw materials into inventory

- Conversion of raw materials into finished products

- Asset purchases

- Ensure 'finance owned' transactions are correctly recorded and valued, for example:

- Assets: Investments and cash movements

- Fixed assets depreciation

- Liabilities: Loans and debt

- Ensure transactions managed by other areas are correctly recorded and valued, for example:

- Implement and manage controls for all financial transactions

- Ensure that business decisions consider all relevant financial factors including helping to steer the business through financial insights

- Manage financial processes, for example:

- Ensure suppliers are paid

- Ensure payments are received and processed

- Prepare financial reports for various stakeholders, including for example:

- Statutory authorities

- Regulatory bodies

- Shareholders

- Internal decision makers.

- Specialist areas such as tax are often considered as part of finance.

This can be summarised as the correct recording and processing of financially relevant business activities and reporting and communicating results in as efficient a way as possible.

Questions to consider at different stages of the process:

Inputs: the recording of financially relevant activities:

- Who records the transaction (departments, teams)?

- Where are they recorded (which locations, which systems)?

- What level of automation is in place?

- Are there errors? Are multiple reviews and correction required?

Processing: correcting, adjusting, aggregating and summarising:

- Who does the processing work (departments, teams)?

- How many steps are there?

- What level of automation is in place?

- What level of re-charging, cross-charging, and allocations take place?

Outputs: reports summarising financially relevant business activities:

- How many reports are prepared, by whom?

- What level of automation is in place?

- How much manipulation is required to create reports?

- Is all of the data contained in reports utilised?

- Is some data missing?

- Is reporting effort duplicated across business areas, or systems?

When assessing the finance function there are a range of documents that can be reviewed. These include:

- The finance policy (or accounting policy)

- The log of accounting issues

- The auditors reports

- Organisation design documents

- Organisation charts

- Roles / job descriptions

- Process documents

- Process maps

- Work instructions

- Documented workarounds

- IT documents

- User guides and handbooks

- Design specifications for systems

- Plans and reports

- Key meeting agendas & minutes

- Issue lists, change lists, problem lists

- In-flight project information

- Project initiation documents

- Status reports

- Requirements documents and design specifications.

Assessing finance metrics

The best place to start is the cost of the finance function. As with other service functions the main cost will either be staff costs or external service providers.

In the case of the internal finance function the sizing and suitability can be examined by looking at the organisation model and role descriptions alongside the scale of transactions and complexity of the overall operation. This is a point that can be benchmarked internally or externally.

In addition to staffing costs, other costs to look at include:

- Accountancy fees for external accountants

- Consultancy fees

- Audit fees

- Finance systems costs including:

- Enterprise resource planning

- Financial planning and analytics

- Management reporting

- Consolidation and statutory reporting

- Disclosure / return preparation

- For all systems consider license fees, maintenance costs and development costs.

In addition to costs finance processes can be analysed through process and data metrics:

- Volume of transactions by type and status

- Number of data elements managed.

Assessing the accounting policy

A poor quality accounting policy can lead to processing issues:

- Uncertainty on how to handle certain transactions

- Inconsistencies and variation in recording and valuing activities.

Questions to consider:

- Does the policy exist?

- Is it up to date and complete?

- Is there an organisation specific interpretation of IFRS/local GAAP?

- Are valuation guidelines and rules clear for different transaction types?

- Are clear codification rules included (account and management objects)?

- Are appropriate materiality limits included?

- Is delegation of authority covered?

- Are spend limits clear?

- Are accounting controls clear?

- Are roles clear including key roles such as financial controllers?

- Is there a documented process for accounting issues and escalation?

Assessing finance process

- Are processes well documented?

- Are processes standardised?

- Do exceptions/issues exist, are they documented?

- Do variations exist, are they documented?

- Are process responsibilities clear including task to role mapping.

Accounting specifics:

- Are any business activities recorded in finance manually?

- Are open items cleared in a timely manner (aging analysis)?

- How well do finance sub processes perform, for example:

- Accounts payable: right first time, payment on time, rejected payments

- What level of manipulation do finance people do on financial data?

- Reversals

- Adjustments

- Recharges

- Cross charges

- Allocations

- How much effort goes into migrating financial data across systems?

- How many reports are prepared:

- Are any reports prepared manually in tools such as excel and access?

- Is there duplication of effort across different reporting tools?

- How many days does it take to run periodic financial closing?

- How many days does it take to run periodic management closing?

- Is there any misalignment between financial and management accounts?

- How many accounting and audit issues exist?

Assessing people & organisation

- How well designed is the finance organisation model:

- Level of centralisation (scale)

- Level of outsourcing (labour arbitrage, access to expertise)

- Presence of business partnering / dedicated business analytics roles

- Presence of supporting technical roles such as technical accountants

- Pooling of delivery roles such as A/P across business areas.

Assessing data & information

Topics to consider include:

- Financial data structure complexity:

- Legal entities

- Accounts

- Currencies

- Transaction types

- Management data structure complexity:

- Cost centres

- Profit centres

- Duplication of finance data across systems

- Overproduction of finance data:

- Reports with unnecessary data

- On demand report generation: is it all necessary, value-add

- Underproduction of finance data:

- Do discussions and decisions suffer from lack of supporting data.

Assessing finance systems

- Is an integrated enterprise resource planning system and the associated automation of transaction capture in place?

- What extent of automation is in place?

- Basic automation 'out of the box' with systems

- Tools such as robotic process automation (RPA) to automate user steps

- Tools such as artificial intelligence e.g. chatbots

- Are there a significant number of interfaces?

- Does this lead to any additional reconciliation effort?

Finance costs to analyse

- Employee costs for finance

- Audit fees

- Consultancy fees

- Finance systems license and maintenance; ERP and reporting tools.

Human resources

Human resources manage the hire to retire cycle. A primary focus of this is the recruitment and retention of talented individuals.

Key processes:

- HR strategy

- Advising and administration of the organisation structure

- Co-ordination of employee communications

- Talent pipeline, talent acquisition

- Leavers

- Succession planning

- Learning and development

- Objectives & performance management

- Compensation management

- Benefit delivery

- Personnel administration

- HR contact centre

- Payroll

- Time management

- Reporting / analytics

- Business partnering

Assessing HR metrics

- Hiring statistics

- Retention statistics

- Regretted leavers statistics and reasoning

- Process measures:

- Travel expense processing (number of claims, blocks, rejections)

- Employee requests processing (number of request by type)

Assessing HR policy

- Policy quality and consistency on key HR factors:

- Salaries & Benefits

- Travel

- Performance management including disciplinary procedures

- Facilitation of basic training for employees:

- Including new corporate processes and policies.

- Simplicity and consistency of reward; benefits, salary etc.

Assessing HR processes

- Do HR adequately support other business areas on key people matters?

- Recruiting for key roles and managing leavers

- Performance management (objective setting, reviews etc.)

- Skills and capability management.

- Do processes exist to manage and retain top performers?

- Are succession plans in place for key roles?

- Does HR drive high quality, consistent employee communications?

- Is the handling of employee requests well managed?

- Are travel expenses processed on time, without error?

Assessing HR people and organisation

- Is the organisation model well documented?

- Is there a detailed and up to date organisation chart?

- Do job descriptions / role descriptions exist for all roles?

- Is the HR function centralised?

- Is HR outsourcing leveraged (opportunity areas include payroll)

Assessing HR data & information

- What level of manual data manipulation takes place:

- Administration of employee data

- Processing employee requests

- Manual report creation.

Assessing HR systems

- Are HR systems fully integrated with finance (expenses and payroll)

- As with finance, what extent of automation is in place?

- Are there a significant number of interfaces?

- Does this lead to any additional reconciliation effort?

HR costs to analyse

- Employee costs

- Outsourcing if in place e.g. payroll

- Specialist administration costs e.g. pensions

- Consultants and advisors.

Information technology

Key processes areas within IT include:

- Processes:

- IT strategy

- IT architecture management

- IT service management

- IT systems development

- IT systems security

- IT project and portfolio management

- IT business partnering

- IT areas:

- Technical infrastructure

- Operating platforms, middleware, network etc.

- Business applications

- By domain; finance, HR etc.

- Internet

- Mobile

- Desktop

- Technical infrastructure

Metrics and reports:

- Service metrics:

- Incidents, change requests, problems

- Availability

- Capacity.

- Security incidents/log

- Projects:

- Success criteria

- Issues created by projects

- Service provider / contact metrics

Questions to consider:

- Does an IT policy exist, is it complete? Does it cover items like:

- Approved apps

- Web filtering rules

- Security policy

- IT procurement rules, approved vendors.

- Is architecture management in place, this can apply at various levels:

- Technical infrastructure architecture

- Business applications architecture across various domains

- Is there a clear strategy of on-premise vs. software as a service?

- Is there a project and portfolio management office in place?

- What's the success rate for IT projects?

- Are 'lessons learned' captured and integrated into future projects?

- Are integration points well managed across IT projects?

- How well defined and managed are processes around issues, changes and problems?

- How well defined and managed is the application development process?

- Is IT outsourcing in place?

- How well managed is desktop?

- Connecting to data, does IT have a master data management system?

People and organisation:

- Is the organisation structure clearly documented?

- Are role descriptions in place for all IT roles?

- What level of centralisation is in place?

- Is IT outsourcing utilised?

- What level of reliance is there on contractors or consultants?

IT systems:

- What level of 'lock-in' exists with software suppliers

- What extent of legacy systems exist? What is the level of risk?

- Factors related to the architecture:

- Complexity: number of applications (level of fragmentation)

- Level of integration of different business systems

- Manual vs. automated interfaces (and reliability of automation).

Costs to consider:

- Hardware costs from data centres and servers to network and desktop

- Software licensing costs

- Software as a service fees

- Employee costs

- Consultancy costs.

Facilities and workplace

Key processes:

- Facility maintenance

- Fixtures, fittings, furnishing etc.

- Asset management

- Security

- Health and safety

- Cleaning

- Food and drink.

Questions to consider:

- What's the organisation structure of the facilities team?

- How many physical locations does the organisation use?

- Are locations owned or leased

- What are the costs associated with the locations?

- Benchmark internally and externally

- What are the benefits per location:

- Access to skilled workers

- Proximity to sources of raw materials or customers

- Are physical assets correctly inventoried and well managed?

- What level of outsourcing is in place?

- What feedback exists from employees and customers on the facilities?

Key costs to analyse:

- Leasing costs

- Employee costs

- Outsourcing costs

- Equipment costs.

External assessments

Another assessment area to consider as part of business transformation is the external environment. These are outside of the scope of this discussion, but the following could be considered:

- Economic analysis

- Policy research

- Market analysis

- Competitor analysis

- Research into new products and technologies.

Conclusions

I hoped to cover a few things in this article:

- Business transformation can suffer from an incorrect understanding of the current state. Usually due to a lack of assessment or a poor quality assessment.

- Assessments take place at different levels of detail from issue, idea or opportunity identification through to transformation project completion.

- Frameworks, approaches and business area checklists can help us plan and execute good quality assessments.

Every situation is unique:

- Organisations vary (public, private, industry, product etc.)

- Business areas, functions, departments, teams vary

- Attributes such as people, processes, systems and data vary.

And I'd recommend to always think carefully about transformation and assessments and customise them to the situation.

Finally, I'd re-cap key watch-outs and barriers related to assessment and transformation:

- Lack of time/budget/resource to run an assessment, suggestions:

- Clearly quantify the risks and impact of a limited assessment

- Consider carefully how the assessment can be tailored and focussed to critical items

- Make as much use of existing documented information as possible.

- 'Blockers': employees / managers that don't engage:

- Understand their motivation, and look for compromise

- Check if they can be circumvented

- Leverage stakeholders as required.

- Lack of documentation (policies, roles processes, systems specifications, data libraries):

- Prepare questionnaires

- Look for sample documents from other business areas/organisations as templates to start

- Observe by work-shadowing

- Workshop the target state to try and identify key differences from the current state

- Lack of metrics:

- While undesirable sometimes manual data gathering and manipulation is beneficial in the short term

- Lack of expert knowledge:

- Role backfilling to free up expert resources

- Engage consultants / contractors

- Portfolio review, ensure initiatives are correctly prioritised by business risk and value.

- Incomplete methodologies:

- Be aware that most project methodologies and change methodologies are incomplete, always think carefully to make sure everything is covered.

Share, comment/discuss

Share to: LinkedIn, X